-

BackWhat we doNumis is an ambitious, dynamic and innovative investment bank, driven to excel across all aspects of its delivery.Investment Banking

-

BackLatest newsRead the latest news about our business, our people and our work, find out about our next events and conferences.News

-

BackWho we areOur collaborative environment and distinctive way of excelling , is nothing without our great people.

-

BackOur board

Femtech funding showing its resilience

Following 2021's record heights, the slowdown in venture capital (VC) dealmaking in the last 12 months has been broad and deep, touching all corners of the market. Against this backdrop, and to round out Women's History Month, Numis' Rachel Stott introduces one small but sturdy segment of the market demonstrating its resilience through the cycle - the evolving femtech category.

Beating market trends

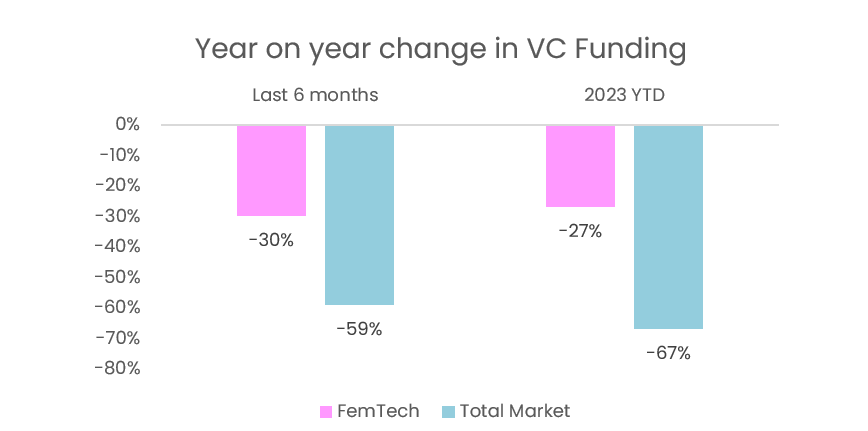

VC funding for femtech startups has outperformed the wider market considerably in the last six months (September 2022 to end-February 2023). While overall VC funding decreased -59% year-on-year (YoY), total femtech deal value in the period only declined -30%.[1]

As the VC market entered deepfreeze in Q4 2022, funding into femtech defied the chill and increased sequentially by 25% on Q3 2022, in stark contrast with the -16% sequential decline for the broader market.[2]

As Q1 2023 plays out, this outperformance is accelerating. In the first two months of the year femtech’s YoY decline slowed to -27%, while the wider market continued to slide, shrinking by -67%.[3]

Source: Pitchbook. Last 6 months is September 2022 to end-February 2023.

49.7% of the world’s population are women[4], and women account for 80% of consumer purchasing decisions in the healthcare industry.[5]

Yet women’s health has historically remained a niche market, commanding just 4% of global medical research spend[6]. Women are underrepresented in physiological research, with just 8% of studies featuring exclusively female participants, a third of those with exclusively male.[7] Despite women making up 70% of patients affected by chronic pain conditions, 80% of pain research is conducted on males.[8] As a result, women are less likely than men to have a heart attack correctly diagnosed[9], more likely to experience bad mental health[10], and spend more of their lives living in poor health.[11]

Femtech companies are seeking to change this. The category includes a broad spectrum of technology-enabled, consumer-centric products, services, devices and software dedicated to addressing women’s health. These companies are utilising data and technology to improve health outcomes for women, whether by improving diagnoses and care delivery, or by enabling better self-care.

This progress is also powered by women; more than 70% of femtech companies analysed by McKinsey in 2022 had at least one female founder, compared with 20% for new companies across the board.[12]

Expanding applications

Femtech startups are proliferating. Today there are 979 that have received VC funding, more than doubling on the 409 five years ago, and just 87 going back a decade.[13] Following steady growth in funding into the sector since 2016, in 2021 femtech deal value surged by 77% to reach $2.1bn.[14]

This momentum in volume and funding of femtech companies reflects the expanding range of health issues affecting women taken on by the femtech ecosystem. Beyond the more established sub-categories of reproductive health and contraception, a new crop of players are building transparency and effective tools for the treatment of other conditions – including menopause, hormonal health, pelvic and sexual health, and those conditions that affect women disproportionately or differently from men, including osteoporosis and cardiovascular disease.

Unlocking a huge end-market opportunity

There is a vast market opportunity for the winners among these companies. The femtech industry is worth $26bn today, with Pregnancy & Nursing, Menstrual Health and Reproductive Health & Contraception the largest subsectors by number of companies.[15]

Looking ahead, the industry is anticipated to scale with a 16.3% compound annual growth rate to pass $97bn in 2030.[16]

This growth is expected to be driven by increasing progress in the use of digital technologies in women’s health, greater education and acceptance of women’s health issues, and the growing prevalence of conditions affecting women.

Deal sizes growing as the category matures

The femtech sector is a relatively young one, and VC-backed deals remain small compared with cross-sector averages – but momentum is positive.

The average deal size for femtech companies in the last six months was 26% higher than in the same period one year prior, as winning companies grow in scale and command greater funding. This bucked the trend of the wider market, which saw a -32% contraction in the average VC deal size across sectors.[17]

As the category comes of age and expands in terms of both impact and size, femtech’s resilience is proving a bright spot in the market downturn.